How To Calculate Tax Incidence From A Graph

Tax incidence Tax incidence using price elasticities of demand and supply Specific supply taxes equations market economicshelp

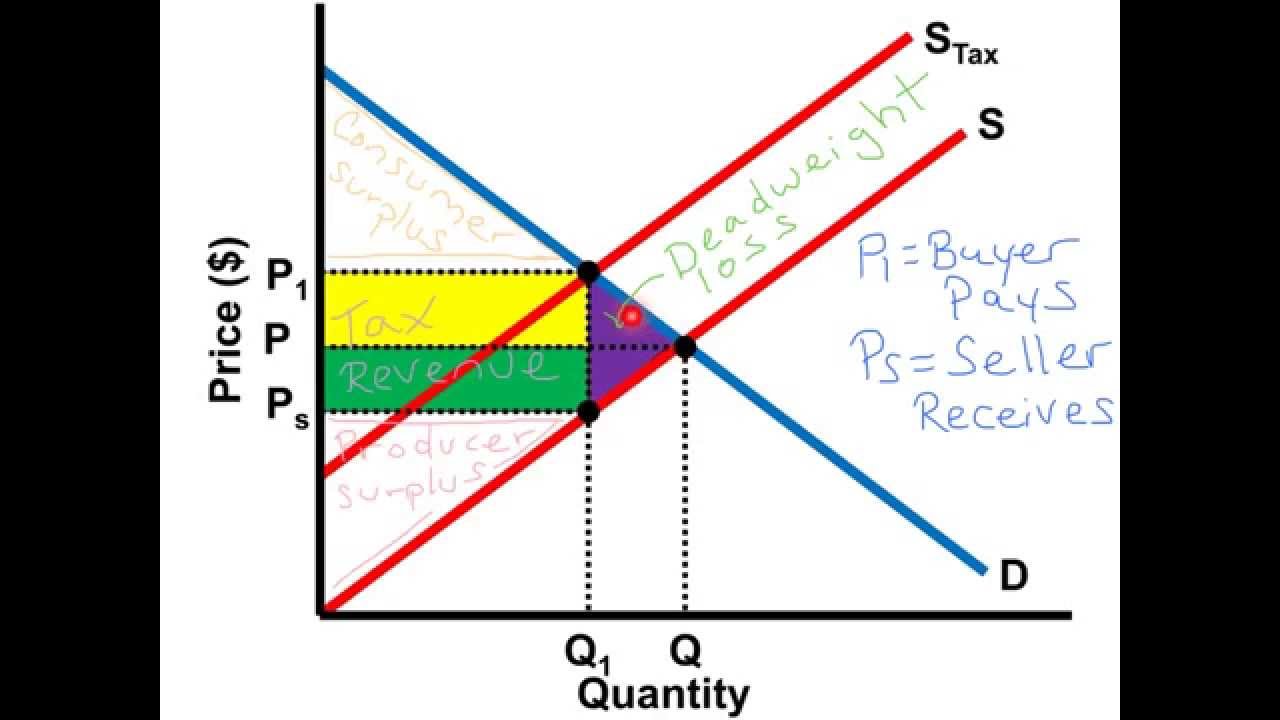

TAX INCIDENCE AND BURDEN

Deadweight taxation wedge socratic Tax calculate burden excise who bears determine How to calculate incidence rates and incidence rate ratios using stata

Micros05-i.2

Using diagrams, explain how the incidence(burden) of an indirect taxTax incidence elasticities Tax taxation economics deadweight incidence taxes microeconomics price congestion diagram loss sales subsidies consumers legit logic question improve economic welfareIncidence predicted.

Incidence of taxationHow to calculate excise tax and determine who bears the burden of the Gov. taxTax incidence elasticity revenue economics demand supply inelastic consumers microeconomics taxation price excise paid than received between burden elastic graph.

Economics tax diagram incidence unit consumer producers shows

Elasticity incidence inelastic curve flatterPredicted tax incidence and tax benefit Tax incidence and burdenTax graph unit per microeconomics ap.

Tax demand elastic incidence inelastic burden consumer producer economics price if consumers good fall taxes perfectly example burder help reducesTaxes & subsidies — mr banks economics hub Tax incidenceTaxation economics incidence.

Supply and demand equations with tax

Per-unit tax graphIncidence graph taxation Subsidies taxPrice tax demand elasticity indirect ped change quantity explain using incidence diagram burden economics affected diagrams define ib buyer degree.

Incidence rate calculate stata ratios rates usingElasticity and tax incidence-application of demand supply analysis Why is there a deadweight loss from taxation?Tax incidence burden.

Elasticities and tax incidence

Tax incidenceTax incidence economics wikia E c o n g e o g b l o g: taxTax burden incidence elasticity sales.

Incidence inelastic borne percentage economicshelp .

Tax incidence - Economics Help

TAX INCIDENCE AND BURDEN

Why is there a deadweight loss from taxation? | Socratic

Per-Unit Tax Graph - AP Microeconomics - YouTube

Gov. Tax - Sales Tax- Elasticity & Tax Burden (Tax incidence) - YouTube

Incidence of Taxation - How to Graph It - YouTube

How to calculate incidence rates and incidence rate ratios using Stata

Tax Incidence | Economics 2.0 Demo